As the dust settles on the 2025 financial year, the Australian strata sector is facing a paradox. According to the Macquarie Bank Strata Benchmarking Report (released January 2026), average management fees per lot have risen by 8% over the last 12 months. On paper, the industry is booming. Yet, Net Profit Margins (NPM) for mid-tier firms have actually compressed, dropping from an average of 22% in 2023 to just 18.5% in 2025.

Where is the money going? The answer lies in the "Efficiency Ceiling."

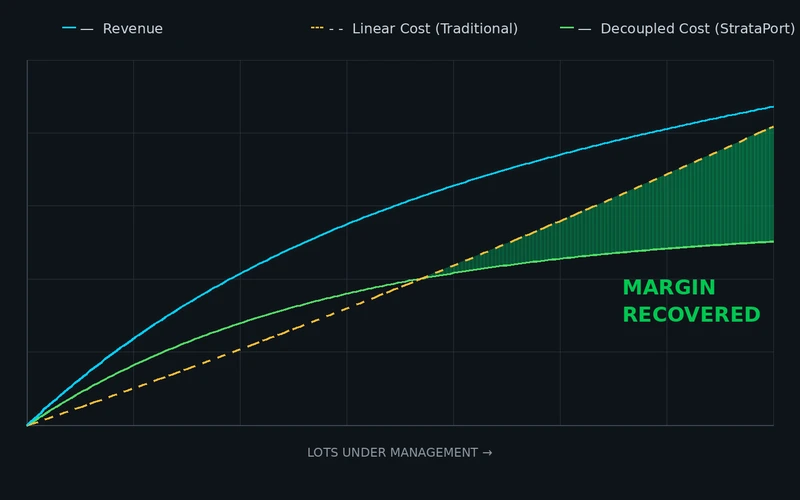

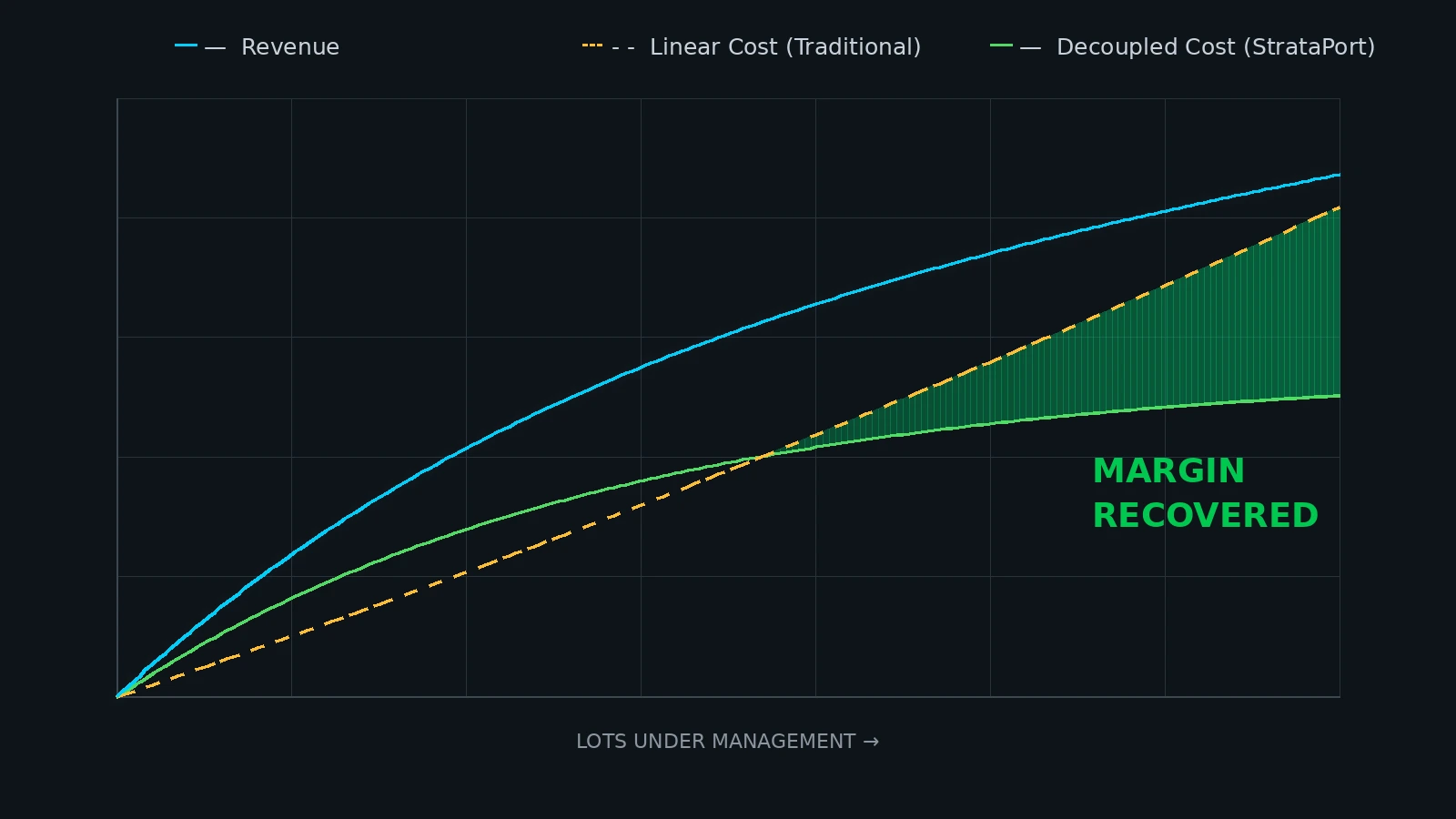

For fifty years, strata management has operated on a linear growth model: to manage 1,000 more lots, you hire 5 more managers. In a low-inflation environment, this was sustainable. In the wage climate of 2026, it is a mathematically broken model.

The "Wage Cliff" of 2026

The shortage of qualified strata managers, exacerbated by the licensing reforms of late 2024, has driven salaries to historic highs. Staff wages now consume, on average, 58.4% of total revenue for standard firms — a sharp increase from the 50–52% standard seen earlier in the decade.

When you factor in the "Compliance Tax" — the estimated 15% increase in administrative load due to the 2025 building defect and insurance transparency regulations — the cost of servicing a single lot has outpaced the fee increase.

The Linear Trap: Why Scale is Hurting You

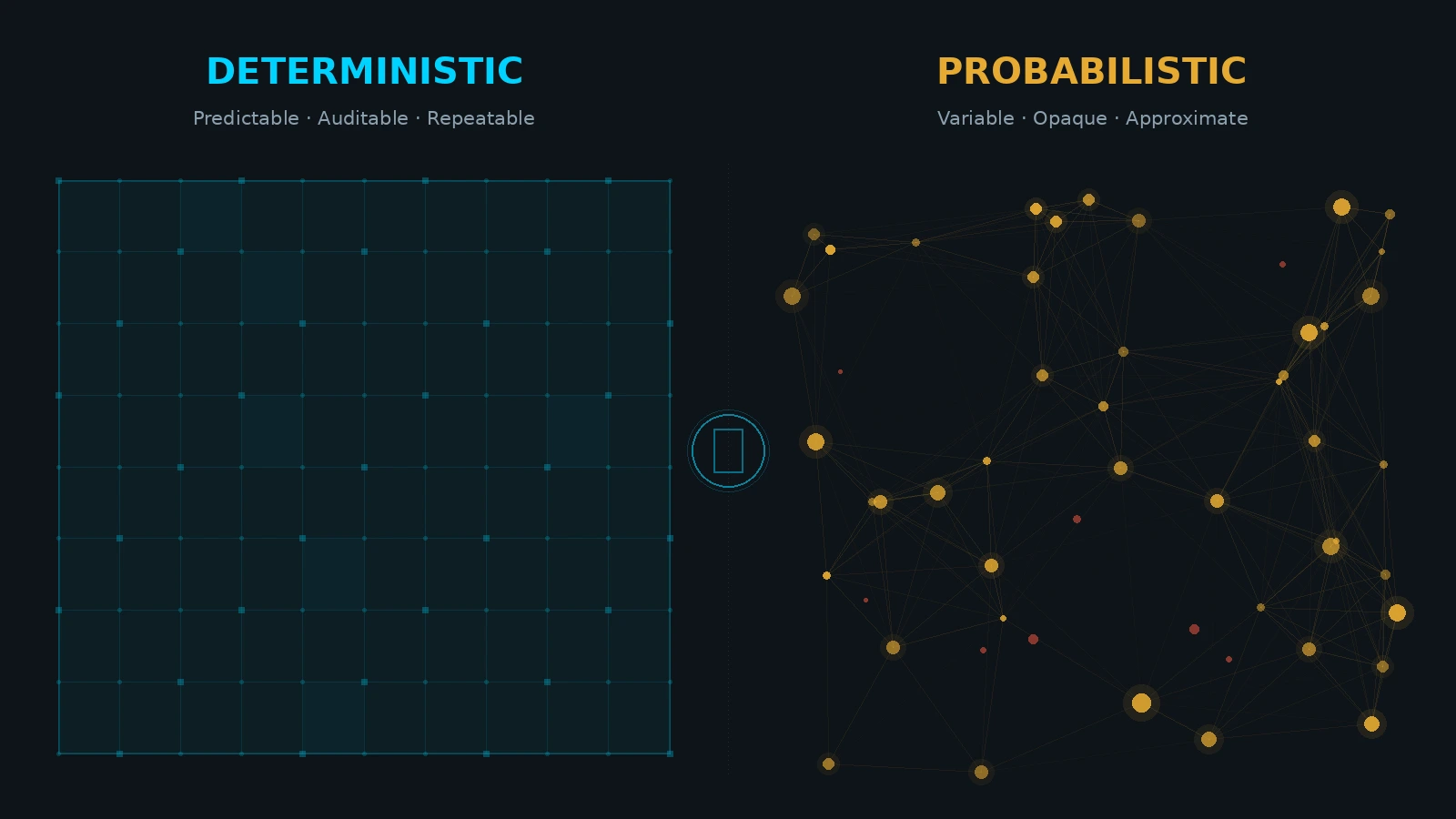

Convention says that scale brings efficiency. In traditional strata firms, the opposite is often true. We call this the Complexity Matrix.

A portfolio of 2,000 lots is manageable with standard tools. A portfolio of 20,000 lots, however, does not just add volume; it adds friction.

- Communication Noise — Inter-departmental handovers increase exponentially

- Error Rates — Manual data entry errors compound, leading to rework cycles that consume senior management time

- Turnover Costs — The burnout associated with high-volume administration drives staff turnover, which costs firms roughly 1.5x the employee's salary in replacement and training costs

If your growth strategy relies on hiring a new manager for every 200 lots gained, you are running up a down escalator.

The "Decoupling" Imperative

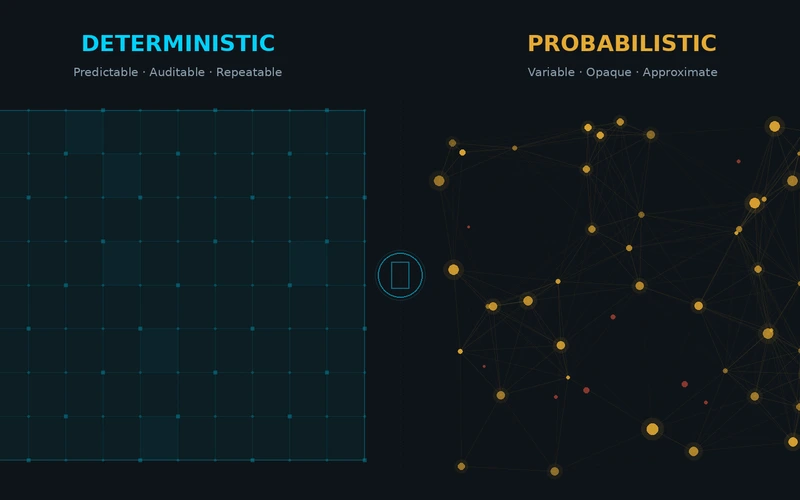

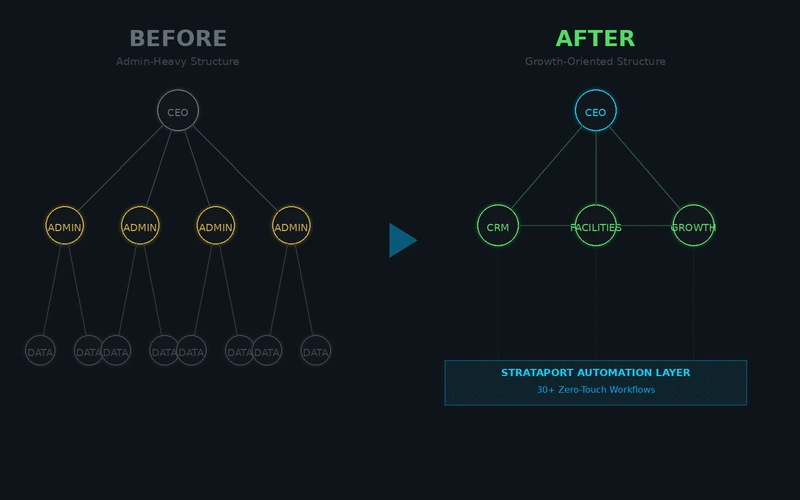

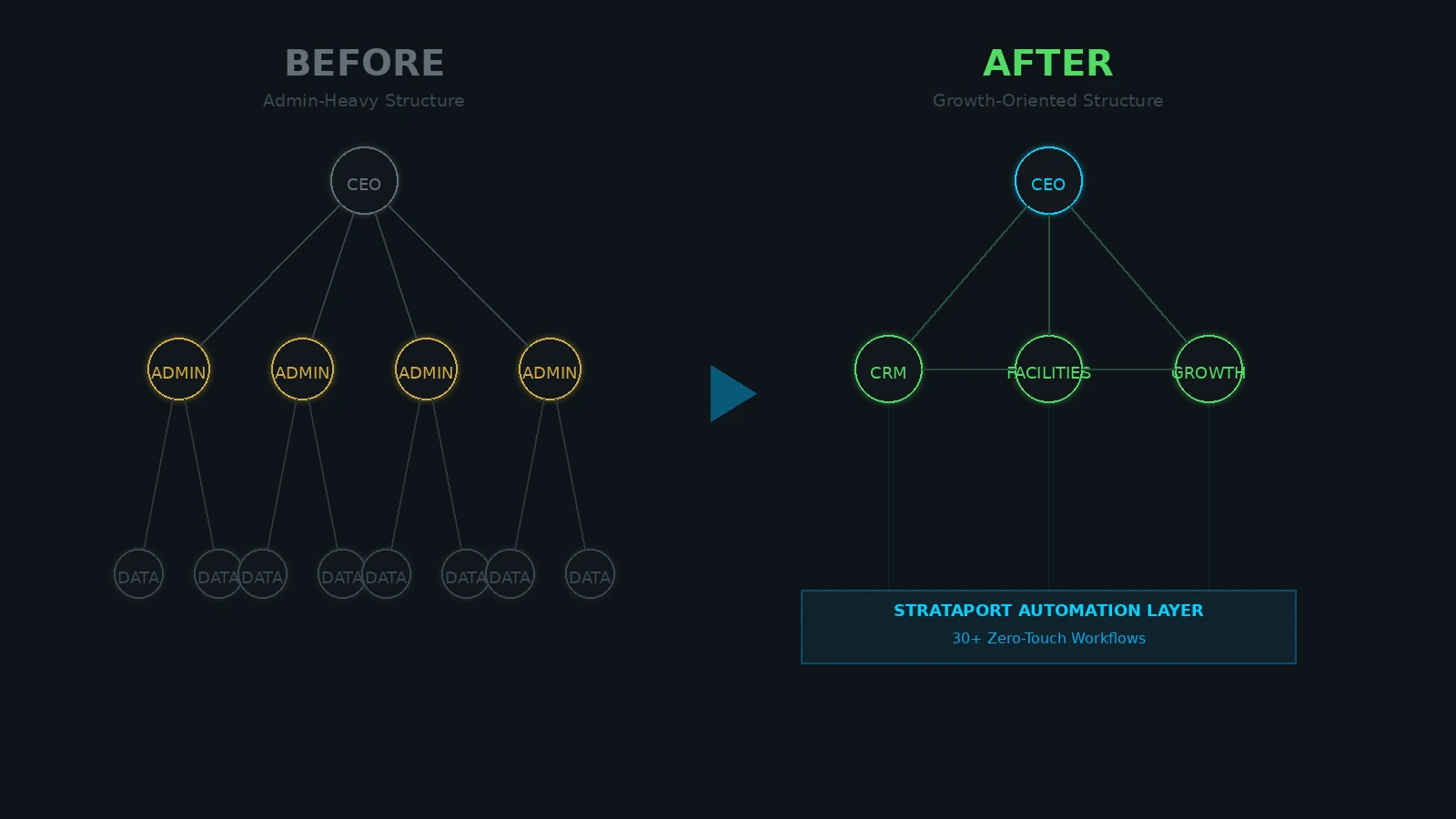

The defining characteristic of the "Alpha Firms" identified in the 2025 benchmarking data — those maintaining margins above 28% — is Decoupling. They have successfully severed the link between revenue growth and headcount growth.

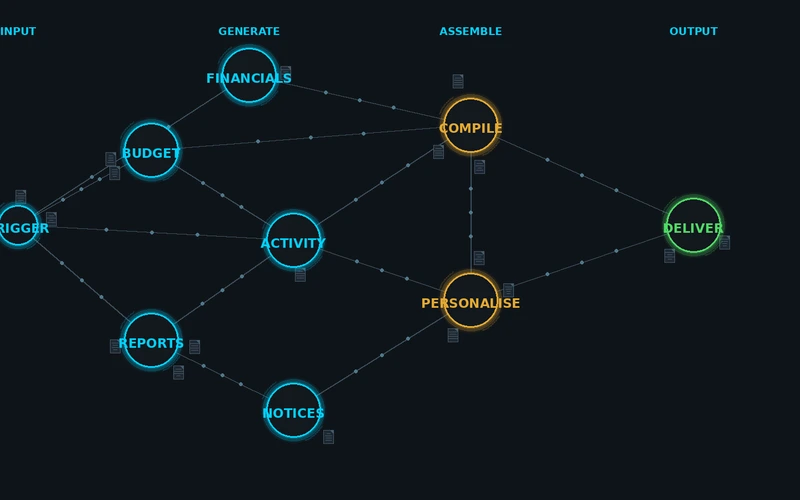

They haven't done this by overloading their staff. They have done it by deploying an "Operational Shield," like StrataPort Plus.

How the Shield Fixes Unit Economics

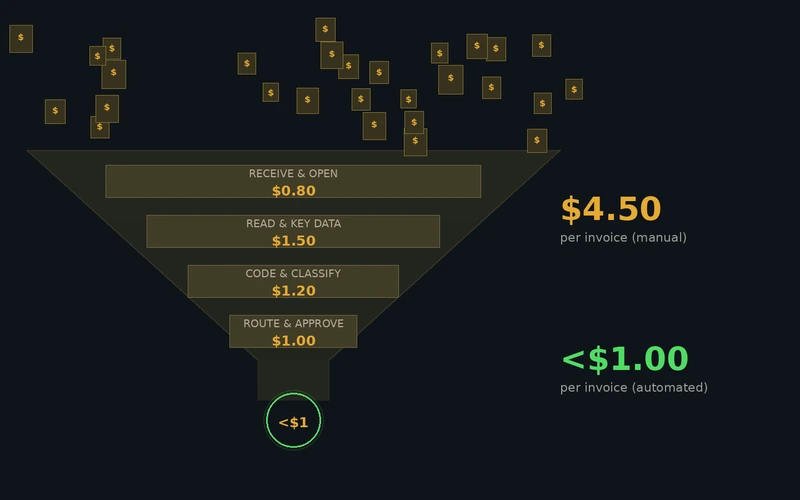

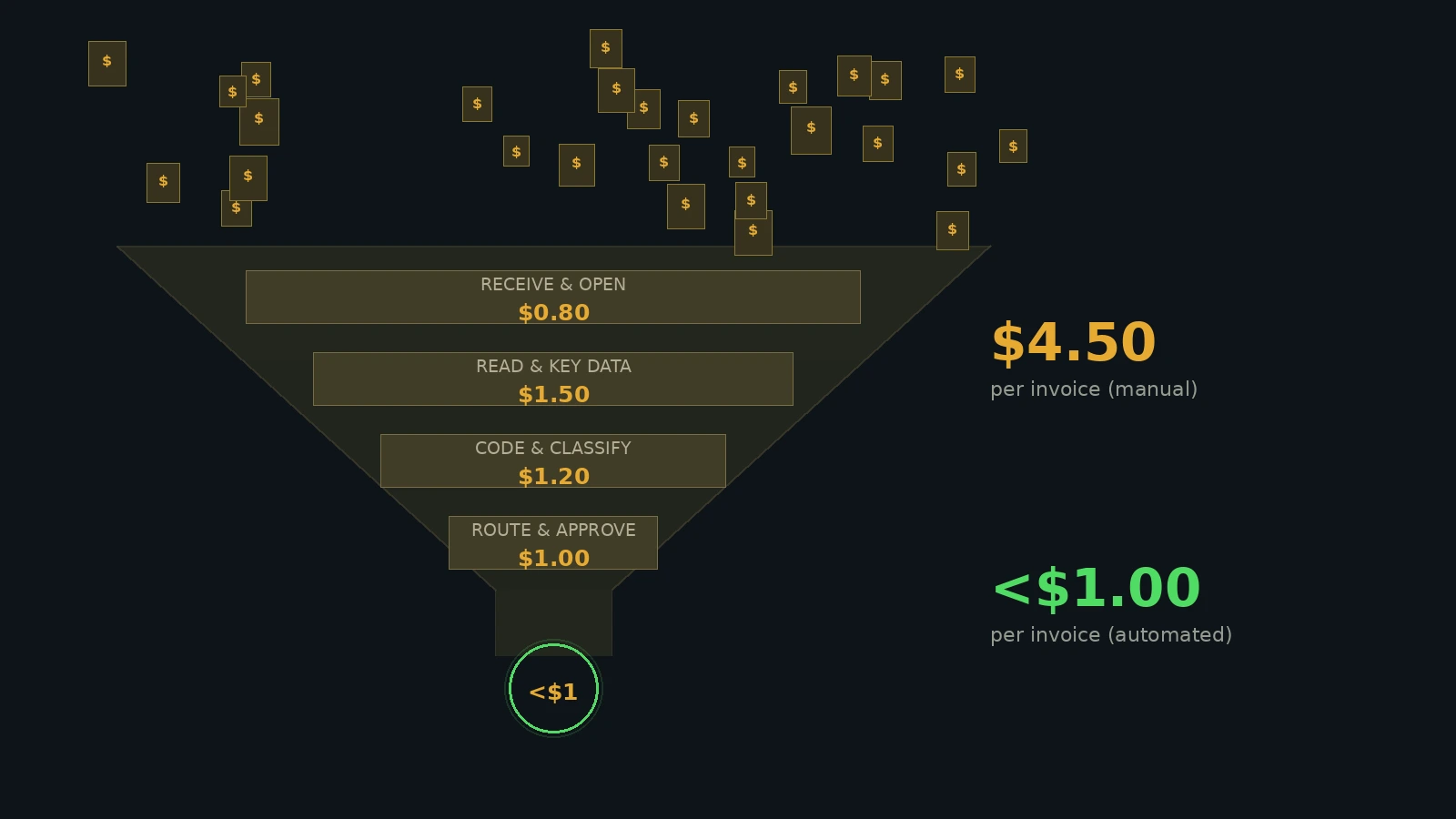

StrataPort Plus attacks the 40% of volume that provides zero strategic value. Consider the lifecycle of a supplier invoice in 2026:

Supplier Invoice Processing — Unit Economics

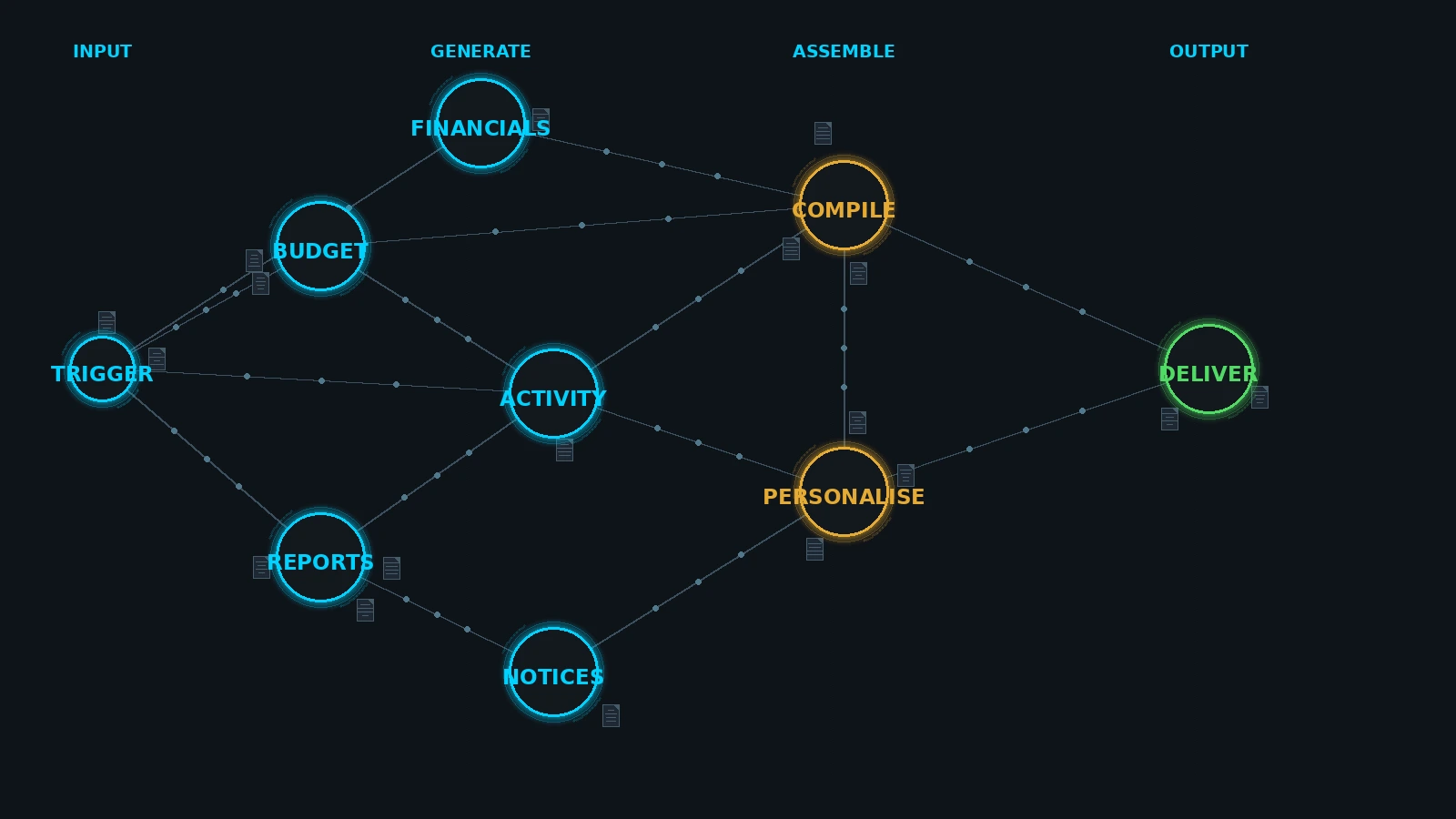

When applied across 50,000 annual invoices, the savings are not marginal; they are transformative. This "Robotic Back-Office" allows a firm to grow by 2,000 lots without hiring a single new administrative support staff member.

Reallocating the Surplus

The goal of StrataPort Plus is not to fire staff; it is to fund the roles that actually drive growth. By reclaiming the budget previously lost to data entry wages, enterprise firms are hiring Client Relationship Managers and Technical Facilities Managers — high-value roles that justify premium fees and prevent client churn.

The Fork in the Road

The data from 2025 is clear. The "Linear Firms" are seeing their margins eaten by wage inflation and compliance drag. The "Exponential Firms" are automating the baseline to protect their margins. In 2026, automation isn't just an efficiency play — it's a survival strategy for the P&L.